How Sanctions as an Economic Weapon continue to shape global power, markets, and geopolitics—and why the U.S. still dominates this financial battlefield.

Table of Contents

Sanctions as an Economic Weapon and America’s Strategic Advantage

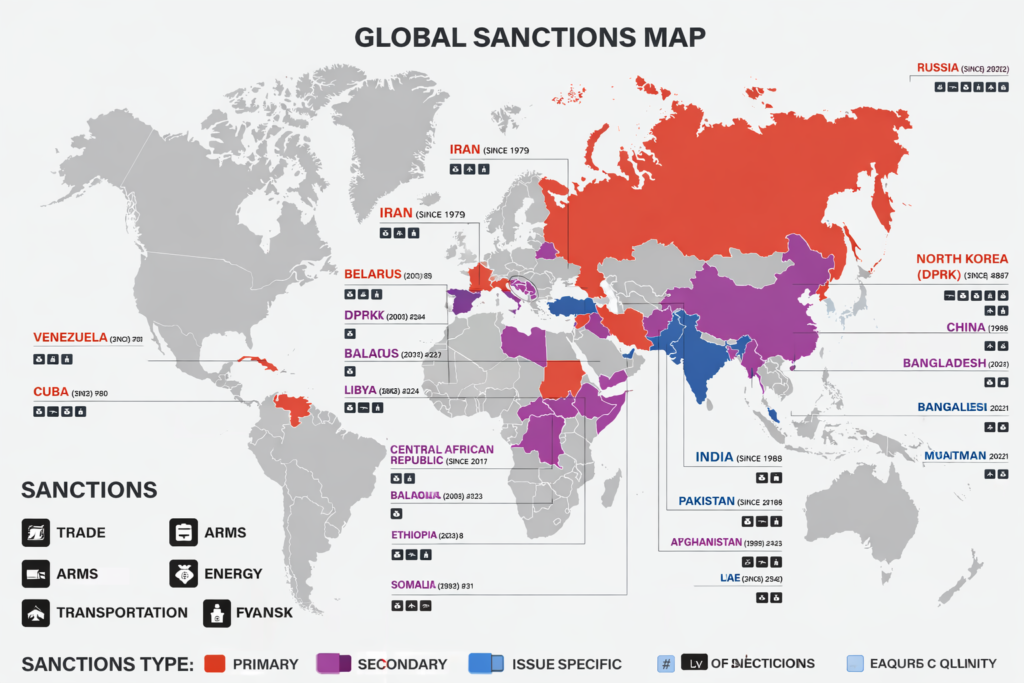

In modern geopolitics, military power is no longer the first response. Instead, financial pressure has become the tool of choice. Sanctions as an Economic Weapon allow countries to punish rivals without firing a single shot, reshaping trade, capital flows, and economic stability.

While many nations impose sanctions, the United States stands apart. Its reach, influence, and financial infrastructure make U.S.-led sanctions uniquely powerful. Even as rival powers push back, America’s dominance in this arena remains surprisingly resilient.

This article explores why sanctions work, how they impact global economies, and why the U.S. still leads despite rising challenges.

What Makes Sanctions as an Economic Weapon So Powerful?

At their core, sanctions aim to isolate—financially, commercially, and diplomatically. They can target:

- Banking systems

- Energy exports

- Technology access

- Sovereign debt

- Individual elites and corporations

What makes Sanctions as an Economic Weapon effective is not just their legal force, but their ability to disrupt trust. Once a country or entity is sanctioned, global businesses hesitate to engage—even beyond what laws require.

This “over-compliance” effect magnifies the economic damage far beyond the initial restrictions.

For a primer on how sanctions function:

https://www.cfr.org/backgrounder/what-are-economic-sanctions

Why the U.S. Dominates Sanctions as an Economic Weapon

The United States enjoys structural advantages no other country can easily replicate.

1. Dollar-Centric Global Finance

Most international trade and finance still depend on the U.S. dollar. Because transactions often clear through U.S. banks, Washington can block access even when deals don’t directly involve American companies.

This gives Sanctions as an Economic Weapon unmatched global reach.

Learn more about dollar clearing:

https://www.federalreserve.gov/paymentsystems.htm

2. Control Over Financial Infrastructure

Key systems like correspondent banking networks and global settlement mechanisms often intersect with U.S. jurisdiction. When sanctions are imposed, foreign banks risk losing access to the American financial system if they don’t comply.

That risk alone forces compliance.

3. Legal and Enforcement Capacity

U.S. agencies aggressively enforce sanctions with heavy fines and criminal penalties. Global banks remember cases where violations led to multibillion-dollar settlements—making future compliance non-negotiable.

Real-World Economic Impact of Sanctions

Sanctions are not symbolic. Their consequences ripple through economies:

- Currency depreciation

- Capital flight

- Inflation spikes

- Supply shortages

- Declining investment

Countries under heavy sanctions often experience long-term structural damage, even if restrictions are later lifted.

This is why Sanctions as an Economic Weapon are feared by policymakers worldwide—they leave scars that outlast political disputes.

Energy, Trade, and Sanctions Pressure

Energy markets are often the frontline. Oil, gas, and commodity restrictions can drain government revenues quickly. When export earnings collapse, states struggle to fund social programs, defense, and infrastructure.

However, sanctions can also reshape global trade routes, benefiting some exporters while harming others. This redistribution effect explains why sanctions influence markets far beyond the targeted nation.

Are Sanctions Losing Effectiveness?

Critics argue that sanctions push countries to build alternative systems—new payment rails, regional trade blocs, or non-dollar settlements.

There is some truth here. Yet despite these efforts, Sanctions as an Economic Weapon remain effective because alternatives lack scale, liquidity, and trust. Global investors still prefer transparent, dollar-based systems over fragmented substitutes.

For analysis on sanctions evasion:

https://www.brookings.edu/articles/do-sanctions-still-work/

The Hidden Costs for the United States

While sanctions strengthen U.S. influence, they are not cost-free:

- Higher global commodity prices

- Retaliatory trade measures

- Supply chain disruptions

- Political backlash

Still, these costs are often judged acceptable compared to military conflict or unchecked adversary behavior.

Sanctions as an Economic Weapon in a Multipolar World

As global power fragments, sanctions will evolve rather than disappear. Future measures are likely to be:

- More targeted

- Technology-focused

- Financially precise

The U.S. continues to adapt faster than rivals, preserving its leadership in financial statecraft.

Why the U.S. Still Leads

Despite growing resistance, America’s combination of financial dominance, legal authority, and institutional trust ensures that Sanctions as an Economic Weapon remain a cornerstone of U.S. power.

Until another nation can replicate the depth and credibility of the U.S. financial system, sanctions will continue to tilt the global balance in Washington’s favor.

Conclusion: Power Without Missiles

Sanctions don’t make headlines like wars—but their impact is just as profound. They quietly reshape economies, alliances, and global behavior.

For now, the U.S. remains unmatched in wielding Sanctions as an Economic Weapon, proving that in the modern world, financial power can rival military force.

Why oil prices remain critical to the U.S. Economy in 2026. Discover how energy costs influence inflation, jobs, consumer spending, markets, and America’s financial stability.