As Fed officials debate housing fixes, supply shortages—not interest rates—are emerging as the biggest obstacle to affordability in the U.S. housing market.

Table of Contents

Introduction: A Housing Problem Monetary Policy Can’t Easily Fix

For years, Americans have blamed high interest rates for the housing affordability crisis. Mortgage costs surged, home prices stayed elevated, and first-time buyers were squeezed out. Naturally, attention turned to the Federal Reserve.

But now, a new reality is setting in.

As Fed officials debate housing fixes, many policymakers are openly acknowledging a hard truth: the housing problem in the United States is less about demand and far more about supply. And supply is something monetary policy has limited power to change.

This shift in thinking matters—not just for markets, but for millions of households waiting for relief.

Why Fed Officials Are Debating Housing Fixes Now

The Federal Reserve traditionally influences housing through interest rates. Lower rates stimulate borrowing; higher rates cool demand. That tool worked reasonably well in past cycles.

But today’s environment is different.

Even as rates rose sharply:

- Home prices remained historically high

- Inventory stayed critically low

- Construction failed to keep pace with population growth

This forced policymakers to rethink the problem. The discussion among Fed officials is no longer just about “when to cut rates,” but about whether rate cuts would even solve the underlying issue.

That’s why Fed officials debate housing fixes that go beyond monetary tools.

The Core Issue: America’s Housing Supply Shortage

At the heart of the crisis lies a structural imbalance.

The U.S. underbuilt housing for more than a decade after the 2008 financial crisis. Builders pulled back, zoning restrictions tightened, and labor shortages worsened. When demand rebounded, supply couldn’t respond fast enough.

Key supply-side problems include:

- Restrictive zoning laws

- High construction and land costs

- Labor shortages in skilled trades

- Local opposition to new development

These constraints limit how quickly new homes can be built—regardless of interest rates.

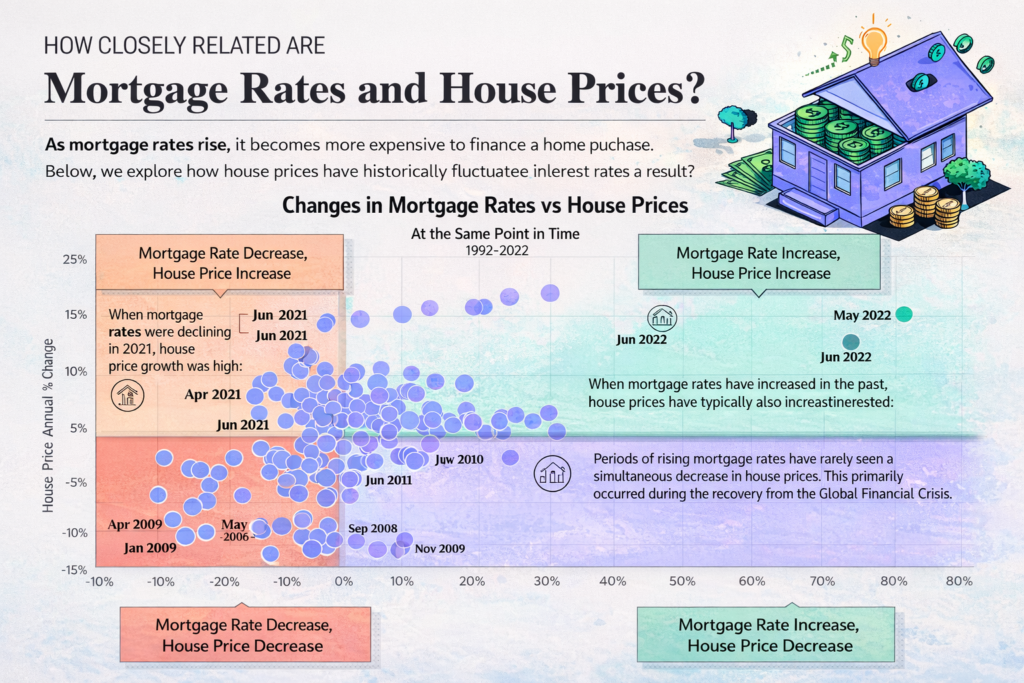

Why Rate Cuts Alone Won’t Fix Housing

One concern repeatedly raised as Fed officials debate housing fixes is that cutting rates too soon could backfire.

Lower mortgage rates might:

- Increase buyer demand

- Push home prices even higher

- Worsen affordability without adding supply

In other words, cheaper credit could reignite bidding wars rather than create relief.

This creates a dilemma for the Fed: stimulate housing demand and risk inflation, or keep rates higher and accept ongoing affordability pain.

Housing Inflation vs Overall Inflation

Shelter costs are one of the largest components of inflation indexes. Rent and owners’ equivalent rent weigh heavily in CPI calculations.

Fed officials worry that:

- Persistent housing inflation keeps overall inflation elevated

- Rate cuts could reignite price pressures

- Supply constraints delay disinflation

This makes housing a central factor in monetary policy decisions—even though the Fed can’t directly build homes.

For official housing inflation data:

https://www.bls.gov/cpi/

The Role of Zoning and Local Governments

As the debate evolves, Fed officials are increasingly pointing to areas outside their control.

Housing supply is largely determined by:

- State and local zoning rules

- Permitting processes

- Infrastructure availability

While the Fed can highlight these barriers, it cannot remove them. That responsibility falls on lawmakers and local governments—often where resistance is strongest.

This reality explains why Fed officials debate housing fixes publicly, even while acknowledging their own limits.

Builders Are Still Holding Back

Even with strong demand, builders remain cautious.

Reasons include:

- High financing costs

- Volatile material prices

- Regulatory uncertainty

- Fear of overbuilding

Until construction becomes more predictable and profitable, supply growth will remain slow. Monetary easing alone may not change that calculus.

How This Debate Affects Homebuyers and Renters

For consumers, the implications are sobering.

If supply remains tight:

- Home prices may stay elevated

- Rent growth could persist

- Affordability may not improve quickly

Buyers hoping for dramatic relief from rate cuts may be disappointed. Renters waiting for large rent declines may face similar frustration.

The Fed’s evolving stance suggests that housing affordability is a long-term challenge—not a cyclical one.

Financial Markets Are Paying Attention

Markets closely watch signals from Fed officials on housing because real estate affects:

- Consumer spending

- Bank balance sheets

- Construction employment

- Inflation expectations

As Fed officials debate housing fixes, investors are recalibrating assumptions about rate cuts, housing stocks, and mortgage markets.

For broader Fed policy context:

https://www.federalreserve.gov/monetarypolicy.htm

A Shift in How Policymakers Talk About Housing

Perhaps the most important change is rhetorical.

In the past, housing was treated as a sector that responded predictably to interest rates. Today, Fed officials are openly acknowledging structural constraints.

This marks a shift from:

- Short-term demand management

to - Long-term structural reform discussions

That alone signals how serious the supply problem has become.

What Real Solutions Might Look Like

While the Fed can’t enact housing policy, the debate highlights possible paths forward:

- Zoning reform to allow higher-density housing

- Faster permitting processes

- Incentives for entry-level home construction

- Public-private partnerships for affordable housing

Without these changes, even perfectly calibrated monetary policy may fall short.

The Political Dimension

Housing affordability is also a political issue. Rising costs affect voter sentiment, migration patterns, and economic mobility.

As Fed officials debate housing fixes, pressure may build on elected officials to act—especially if rate cuts fail to deliver relief.

This increases the likelihood that housing supply becomes a central issue in future policy agendas.

Final Verdict: A Problem Bigger Than the Fed

The current housing crisis exposes a limitation of modern monetary policy.

Interest rates can influence demand, but they cannot:

- Rewrite zoning laws

- Train construction workers

- Speed up local approvals

That’s why the debate inside the Fed matters. It signals a recognition that housing affordability won’t be solved by central banking alone.

Final Thoughts

As Fed officials debate housing fixes, the message is becoming clearer: America’s housing problem is structural, not temporary.

Relief will likely come slowly, through a combination of policy reform, supply expansion, and demographic adjustment—not quick rate cuts.

For households waiting on the sidelines, this may be frustrating. But understanding the real nature of the problem is the first step toward lasting solutions.

👉 Housing affordability won’t be fixed overnight—but ignoring supply constraints will only delay the recovery.

The Trump 10% credit card cap proposal could dramatically change U.S. consumer credit, banking profits, and household debt. Here’s what it means for Americans.