Consumer Sentiment in the U.S. has ticked up despite ongoing job worries. Explore what’s driving cautious optimism, how Americans are spending, and what it means for the economy.

Table of Contents

Introduction: An Unexpected Turn in Public Mood

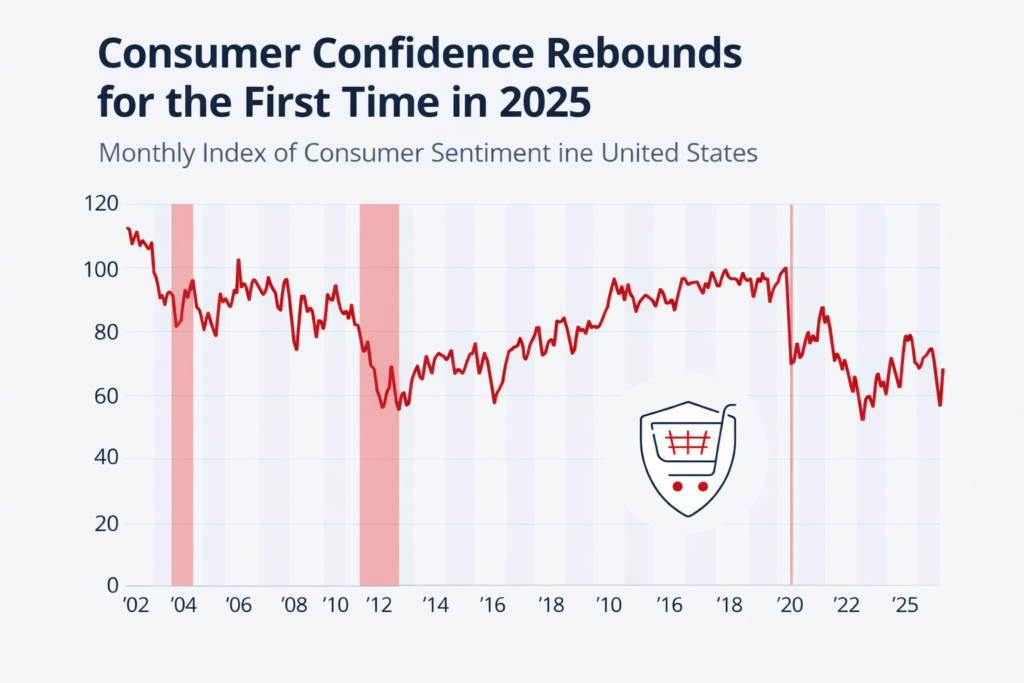

In recent months, the U.S. economy has sent mixed signals. Headlines continue to highlight layoffs, hiring slowdowns, and uncertainty in white-collar jobs. Yet at the same time, surveys show a subtle but notable shift: Consumer Sentiment has improved.

This rise may seem surprising. If people are worried about job security, why are they feeling more optimistic about the economy? The answer lies in how Americans are adapting to uncertainty, adjusting expectations, and finding small signs of stability in their daily financial lives.

This blog explores why confidence is inching upward, what Americans are still concerned about, and how this contradiction could shape the U.S. economy in the months ahead.

What Consumer Sentiment Really Measures

Before diving deeper, it’s important to understand what Consumer Sentiment actually represents. It’s not a direct measure of income or employment. Instead, it reflects how people feel about:

- Their current financial situation

- The broader economy

- Future expectations for income and prices

In other words, sentiment captures emotion, not just math. And emotions often change before economic data does.

One of the most closely watched indicators is published by the University of Michigan:

https://www.sca.isr.umich.edu

Why Consumer Sentiment Is Improving

1. Inflation Pressure Feels Less Intense

Although prices remain high, the pace of increases has slowed. Americans are no longer shocked each time they visit the grocery store or fill up their gas tanks. This “stabilization effect” reduces stress, even if costs haven’t returned to pre-pandemic levels.

Psychologically, slower inflation feels like progress—and that helps lift Consumer Sentiment.

2. Wages Have Caught Up for Some Households

In many sectors, wages rose over the past two years. While not everyone benefited equally, enough households saw income growth to offset higher costs. This has helped some families feel more balanced financially.

Even modest wage gains can change how people view their future.

3. Americans Are Adapting Their Spending Habits

Consumers have adjusted. They are:

- Cutting unnecessary subscriptions

- Delaying large purchases

- Prioritizing essentials

This adaptation gives people a sense of control, which boosts confidence. Feeling prepared often matters more than feeling wealthy.

Job Worries Haven’t Disappeared

Despite improved Consumer Sentiment, job anxiety remains real.

Hiring Feels Slower

Many job seekers report longer hiring processes and fewer callbacks. Even employed workers sense caution from employers, especially in tech, finance, and media.

Layoff Headlines Create Psychological Impact

Even if layoffs don’t affect everyone directly, they shape public perception. High-profile job cuts send a message that stability is fragile.

For labor market data, readers can explore:

https://www.bls.gov

The “Two-Speed” Consumer Economy

One reason Consumer Sentiment can rise while job worries persist is the emergence of a two-speed economy.

- Stable earners (often homeowners or dual-income households) feel cautiously optimistic.

- Vulnerable workers (contractors, gig workers, recent graduates) feel anxious and uncertain.

Both realities exist at the same time. Survey averages often reflect this balance.

How Media Framing Influences Consumer Sentiment

Media coverage plays a powerful role in shaping expectations. When inflation dominated headlines, fear was widespread. As coverage shifts toward “soft landings” and economic resilience, emotions follow.

This doesn’t mean risks are gone—but tone matters.

Spending Behavior Reflects Cautious Confidence

Even with job concerns, Americans are still spending—just differently.

What’s Up

- Travel experiences

- Dining out (selectively)

- Small home improvements

What’s Down

- Big-ticket items

- Luxury goods

- Long-term financial commitments

This pattern signals guarded optimism rather than reckless confidence.

The Role of Interest Rates

Interest rates remain a key factor shaping Consumer Sentiment. While borrowing is still expensive, Americans are beginning to accept current rates as the “new normal.”

When uncertainty becomes familiar, fear often fades.

For Federal Reserve insights, see:

https://www.federalreserve.gov

Why Consumer Sentiment Matters So Much

Consumer spending accounts for nearly 70% of U.S. economic activity. When confidence improves—even slightly—it can:

- Support retail sales

- Encourage business investment

- Stabilize growth

This makes Consumer Sentiment one of the most closely watched psychological indicators in economics.

Younger vs Older Consumers: A Divide

Younger Americans

- More job anxiety

- Higher rent and debt burdens

- Lower confidence in long-term stability

Older Americans

- More savings

- Home equity cushions

- Higher confidence despite market noise

This generational divide explains why sentiment gains are modest rather than dramatic.

Is Optimism Sustainable?

The big question: will this improvement last?

That depends on:

- Whether layoffs remain contained

- How inflation behaves in coming months

- Wage growth consistency

If job losses accelerate, Consumer Sentiment could quickly reverse. Confidence is fragile when built on uncertainty.

How Consumers Are Protecting Themselves

Despite improving mood, Americans remain cautious. Common strategies include:

- Emergency savings

- Skill development

- Side income exploration

- Reduced debt exposure

Preparedness, not denial, is driving today’s optimism.

What Businesses Should Learn

Companies should not mistake rising Consumer Sentiment for complacency. Transparency, stable communication, and employee support remain critical.

Confidence grows when people feel informed—not surprised.

The Bigger Picture

The rise in Consumer Sentiment despite job worries highlights an important truth: people are learning to live with uncertainty. Instead of waiting for perfect conditions, they are adapting, planning, and cautiously moving forward.

This emotional resilience may become one of the defining economic traits of the post-pandemic era.

Conclusion

Consumer Sentiment ticking up does not mean Americans feel carefree. It means they feel capable. Even as job worries linger, people are adjusting expectations, managing risk, and finding reasons to stay hopeful.

For policymakers, businesses, and investors, this quiet shift in mindset may matter just as much as any official economic report.

Latest January 2026 Jobs Data shows Americans are increasingly worried about job security, hiring slowdowns, and future employment stability despite steady unemployment figures.