Is BRICS Expansion reshaping global finance? This deep-dive examines whether the growing BRICS bloc truly threatens Western financial institutions or remains more symbolic than structural.

Introduction: Why BRICS Expansion Is Suddenly Everywhere

Over the last few years, global finance has entered a phase of quiet but profound transformation. Rising geopolitical tensions, repeated sanctions, and dissatisfaction with Western-led financial systems have pushed several nations to explore alternatives. At the center of this shift lies BRICS Expansion, a development that many analysts see as either a turning point—or a geopolitical illusion.

Originally a loose grouping of emerging economies, BRICS has now evolved into a broader coalition aiming to amplify the Global South’s voice in economic governance. With new members joining and discussions around alternative currencies, development banks, and payment systems intensifying, Western policymakers are watching closely.

But is this expansion truly a threat to Western financial institutions, or is its impact being overstated?

What Is BRICS Expansion and Why Does It Matter?

BRICS—initially comprising Brazil, Russia, India, China, and South Africa—was never designed as a military or ideological alliance. Its foundation was economic cooperation among large emerging economies that felt underrepresented in institutions like the IMF and World Bank.

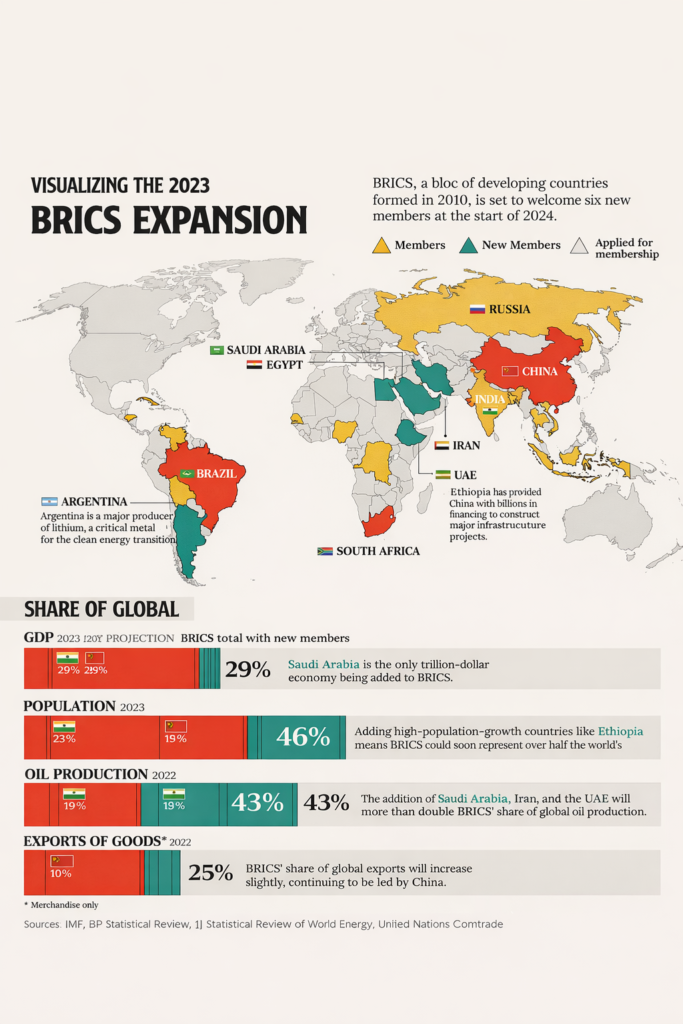

BRICS Expansion refers to the inclusion of new member states from the Middle East, Africa, and Latin America, many of which are energy producers or strategically positioned economies. This matters because the bloc is no longer just symbolic; it now represents:

- A larger share of global population

- Significant control over energy and commodity markets

- Growing intra-bloc trade conducted outside the U.S. dollar

The question is whether size alone translates into systemic financial power.

The Core Fear: A Challenge to Western Financial Institutions

Western financial institutions dominate global capital flows, currency settlement, and crisis lending. The concern surrounding BRICS Expansion stems from three main areas:

- Currency dominance

- Development finance alternatives

- Sanctions resistance

Each of these touches the core of Western financial influence.

Currency Ambitions: De-Dollarization or Diversification?

One of the loudest discussions around BRICS Expansion involves de-dollarization. Several member states have openly criticized reliance on the U.S. dollar for trade and reserves, arguing that it exposes them to geopolitical risk.

However, reality is more nuanced.

While bilateral trade in local currencies has increased, replacing the dollar requires:

- Deep, liquid capital markets

- Strong institutional trust

- Free capital movement

At present, no single BRICS currency—or collective alternative—meets all these conditions.

Rather than a direct attack on Western currencies, BRICS Expansion appears to be about reducing vulnerability, not replacing the global system outright.

Development Finance: Competing with IMF and World Bank?

The New Development Bank (NDB), established by BRICS, is often portrayed as a rival to Western-dominated lenders. Its appeal lies in fewer political conditions and faster approvals.

Yet, scale remains a limiting factor.

IMF and World Bank lending capacity still dwarfs BRICS-backed institutions. What BRICS Expansion does achieve is psychological and political leverage—it gives developing nations negotiating power and alternatives, even if limited.

This alone alters the balance of influence, even without replacing existing systems.

Sanctions, Trade, and Financial Fragmentation

Sanctions have become a central tool of Western foreign policy. For countries frequently targeted, BRICS Expansion represents a hedge against financial isolation.

Alternative payment systems, regional clearing mechanisms, and energy trade in non-Western currencies reduce exposure to sanctions—but they do not eliminate it.

Western financial institutions remain dominant because:

- Global investors still trust Western legal systems

- Capital safety outweighs political alignment

- Crisis liquidity still flows from Western centers

Fragmentation is happening—but slowly.

Is BRICS Expansion Economically United?

One of the biggest misconceptions is treating BRICS as a cohesive bloc.

In reality:

- Members have competing geopolitical interests

- Economic structures differ widely

- Policy coordination is limited

China’s financial weight far exceeds others, raising concerns about internal imbalance. India and Brazil, for example, remain deeply integrated with Western markets.

This internal diversity limits how aggressively BRICS Expansion can challenge existing financial institutions.

Western Institutions Are Not Standing Still

Another overlooked factor is adaptation.

Western financial institutions are reforming governance, expanding emerging-market representation, and modernizing lending tools. Ignoring BRICS Expansion would be a mistake—but so would assuming Western dominance is static.

Global finance is evolving into a multi-layered system, not a binary East-vs-West confrontation.

The Real Impact: Power Shift, Not Power Transfer

The most accurate way to understand BRICS Expansion is not as a financial revolution, but as a rebalancing of leverage.

It:

- Weakens monopoly control

- Increases bargaining power for emerging economies

- Encourages institutional reform

But it does not yet dismantle Western financial leadership.

The threat is indirect, gradual, and structural—not immediate or catastrophic.

What Comes Next?

The future impact of BRICS Expansion will depend on:

- Internal coordination

- Financial transparency

- Institutional credibility

- Global economic shocks

A major financial crisis or geopolitical escalation could accelerate change. Without it, transformation will remain incremental.

Conclusion: Threat or Overstated Narrative?

So, is BRICS Expansion a real threat to Western financial institutions?

Not yet—but it is a warning.

It signals dissatisfaction with the existing order and highlights the need for reform. Western institutions remain dominant, but dominance without adaptation rarely lasts.

The real story is not replacement—it is competition, negotiation, and evolution.

IMF global financial system overview: https://www.imf.org

World Bank on development finance: https://www.worldbank.org‘

BRICS New Development Bank: https://www.ndb.int

As NATO members sharply increase military spending, national economies face rising debt, inflationary pressure, and social trade-offs. This in-depth analysis explains the hidden economic costs behind the defense boom.