The gap between Wall Street vs Main Street is widening. This deep-dive explains why stock markets soar while everyday Americans struggle with inflation, debt, and stagnant wages.

Table of Contents

Introduction: A Boom That Doesn’t Feel Like One

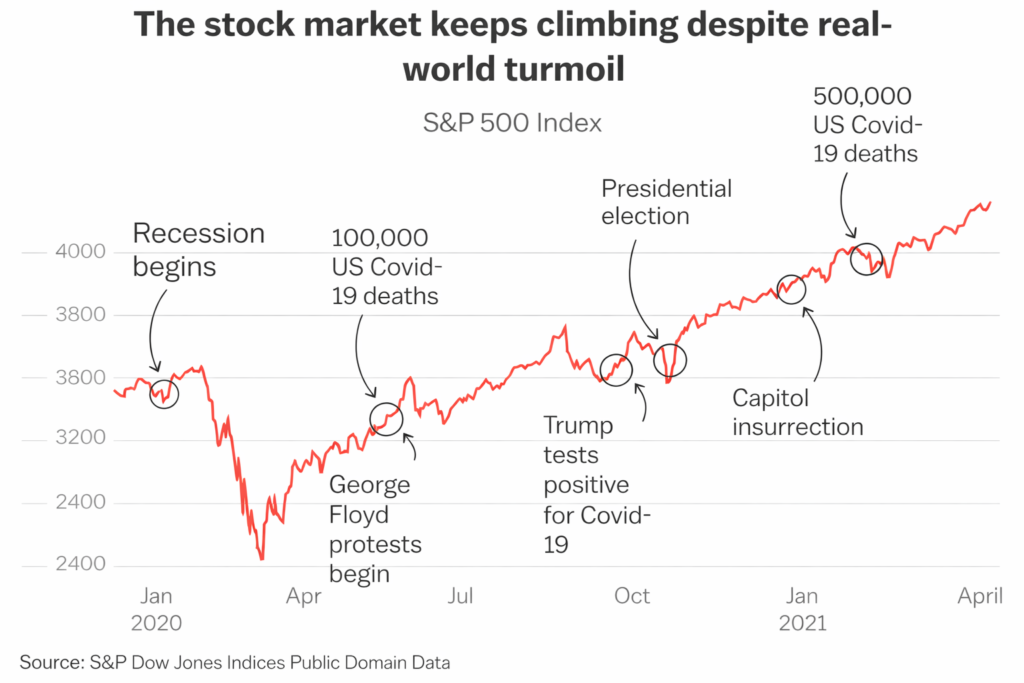

Every time the stock market hits a new high, headlines celebrate economic strength. Indexes rise, investors cheer, and financial commentators declare confidence in the economy. Yet for millions of Americans, daily life feels harder, not easier.

Rent is up. Groceries cost more. Healthcare and education feel increasingly unaffordable. This disconnect raises a critical question at the heart of Wall Street vs Main Street: how can markets be thriving while households feel poorer?

The answer lies in how modern economies distribute growth, risk, and rewards.

What Wall Street Actually Measures—and What It Doesn’t

Wall Street reflects asset performance, not lived economic reality.

Stock markets primarily track:

- Corporate profits

- Future earnings expectations

- Investor sentiment

- Liquidity conditions

They do not directly measure wages, job security, or cost-of-living pressures.

When central banks inject liquidity or keep interest rates low, asset prices often rise—even if household finances remain stressed. According to the Federal Reserve, monetary policy affects financial markets faster than the real economy

(https://www.federalreserve.gov).

This structural delay fuels the Wall Street vs Main Street divide.

The Asset Inflation Effect

One of the biggest drivers of the gap is asset inflation.

Rising stock and housing prices disproportionately benefit those who already own assets. Meanwhile, renters and workers without significant investments face higher living costs without equivalent income growth.

The International Monetary Fund has repeatedly warned that prolonged asset inflation increases inequality even during periods of economic expansion

(https://www.imf.org).

In short: markets reward ownership, not labor.

Corporate Profits vs Worker Pay

Corporate earnings have grown far faster than wages over the past two decades.

Companies boost profits through:

- Automation

- Cost-cutting

- Global supply chains

- Financial engineering

Stock buybacks and dividend payouts push share prices higher, directly benefiting investors. But wage growth often lags inflation, leaving workers with shrinking purchasing power.

This dynamic sits at the core of Wall Street vs Main Street frustration.

Inflation Hits Main Street First—and Hardest

Inflation is not evenly felt.

Higher-income households spend a smaller share of income on essentials. Lower- and middle-income families feel price increases immediately in food, fuel, rent, and utilities.

While markets often rise during inflationary periods—pricing in higher nominal earnings—real household income may fall.

The World Bank notes that inflation disproportionately harms households with limited savings and fixed incomes

(https://www.worldbank.org).

Markets adapt faster than people.

Debt Masks Economic Stress—Until It Doesn’t

Easy credit can temporarily soften economic pain.

Consumers rely on:

- Credit cards

- Buy-now-pay-later services

- Student loans

This sustains spending even as real income stagnates. Markets interpret continued consumption as strength, pushing stocks higher.

But rising debt eventually becomes a burden. When repayment pressures grow, Main Street feels the pain long before Wall Street reacts.

Why Financial Markets Feel “Disconnected”

Modern financial markets are global, digital, and speculative.

Capital moves instantly across borders chasing returns. Meanwhile, wages, housing supply, and infrastructure adjust slowly.

This speed mismatch explains why Wall Street vs Main Street feels like two separate economies operating side by side.

The Role of Government Policy

Fiscal and monetary policies often stabilize markets first to prevent systemic collapse.

Bailouts, stimulus, and liquidity programs protect financial plumbing. While necessary, these actions often inflate asset prices before improving job quality or affordability.

This sequencing unintentionally deepens public frustration.

Psychological Impact: When Numbers Don’t Match Reality

Repeated headlines about market highs create a sense of alienation.

People begin to question official narratives when personal experience contradicts macro indicators. Trust erodes—not just in markets, but in institutions.

This psychological divide is one of the most dangerous aspects of Wall Street vs Main Street, because it fuels political polarization and social tension.

Is the Economy Actually Strong?

The honest answer: parts of it are.

Corporate balance sheets may look healthy. Investors may be optimistic. But economic strength is unevenly distributed.

An economy can be profitable without being broadly prosperous.

Can the Gap Be Closed?

Closing the divide requires structural change, not slogans.

Key areas include:

- Wage growth tied to productivity

- Affordable housing supply

- Fairer tax structures

- Investment in skills and infrastructure

Markets alone cannot solve inequality—but ignoring market signals creates other risks.

Why This Divide Matters for the Future

Persistent divergence between financial markets and lived reality creates instability.

When people feel excluded from growth, they reject systems they believe no longer serve them. That backlash can reshape policy, markets, and democracy itself.

Understanding Wall Street vs Main Street is not just an economic issue—it is a societal one.

Conclusion: Two Economies, One Country

Wall Street celebrates numbers. Main Street lives consequences.

Until growth feels real in everyday life—not just on screens—the gap will continue to widen. Markets may keep rising, but without shared prosperity, that rise rests on fragile ground.

The next Global Financial Shock won’t start in banks or markets—it will begin in politics. Here’s how elections, sanctions, and power struggles can trigger a financial crisis.