The next Global Financial Shock won’t start in banks or markets—it will begin in politics. Here’s how elections, sanctions, and power struggles can trigger a financial crisis.

Table of Contents

Introduction: The Crisis No Balance Sheet Can Predict

Most people imagine financial crises starting the same way: bad loans, risky banks, collapsing markets. That mental model is outdated. The next Global Financial Shock is far more likely to begin in parliament buildings, war rooms, or election campaigns than in trading floors.

In today’s world, politics no longer reacts to markets—markets react to politics. Governments weaponize trade, currencies, technology, and regulation. As a result, financial stability now depends less on spreadsheets and more on political decisions.

This shift has profound implications for investors, economies, and everyday citizens.

Why Banks Are No Longer the Weakest Link

After the 2008 crisis, banks were forced to strengthen capital buffers, improve transparency, and undergo stress tests. While risks remain, the financial system is more regulated and resilient than before.

Politics, on the other hand, has become more volatile.

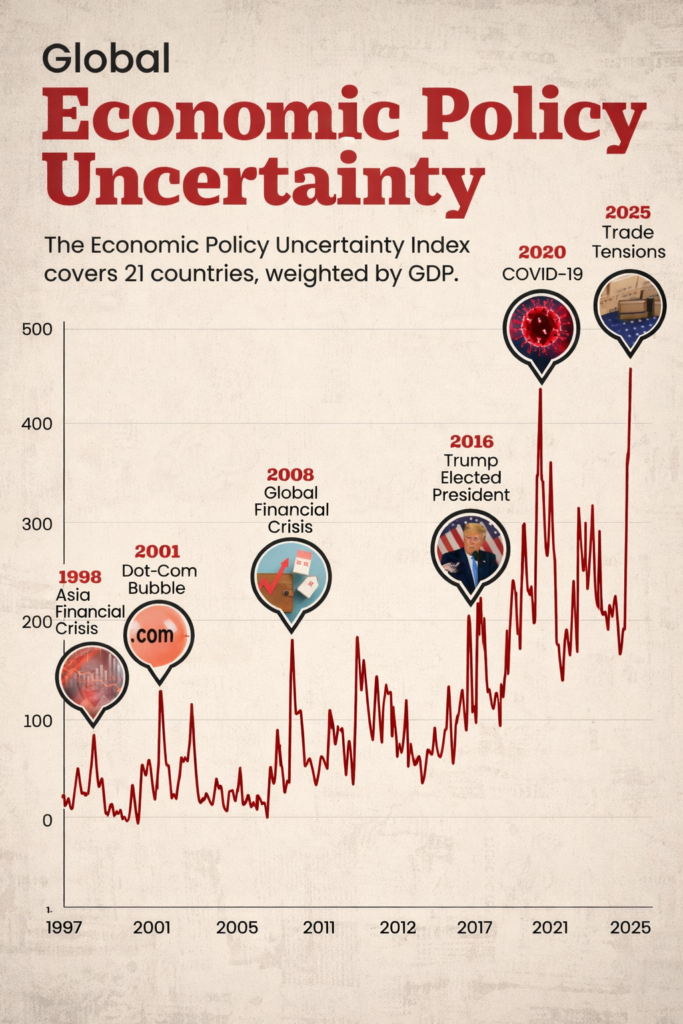

Sudden policy shifts, sanctions, and regulatory surprises now move markets faster than interest-rate decisions. According to analysis by the International Monetary Fund, geopolitical risk has become one of the most significant drivers of global financial instability

(https://www.imf.org).

This is why the next Global Financial Shock is unlikely to start with a bank failure.

Elections: The New Market Earthquakes

Elections were once domestic political events. Today, they are global financial triggers.

Markets now price in:

- Policy reversals

- Trade realignments

- Sanctions escalation

- Fiscal unpredictability

A single election outcome can reprice currencies, bonds, and commodities overnight. The shock doesn’t come from economic weakness—but from uncertainty.

Political polarization makes long-term policy commitments fragile, increasing systemic risk.

Sanctions and Economic Weaponization

Sanctions have evolved from targeted diplomatic tools into systemic financial weapons. Freezing reserves, restricting payment systems, and banning technology exports reshape entire economies.

The World Bank has warned that repeated use of economic coercion accelerates fragmentation and raises the risk of spillover crises

(https://www.worldbank.org).

When countries lose access to global finance overnight, the shock ripples through energy markets, supply chains, and currencies—often without warning.

This is how a Global Financial Shock can emerge without a single bank collapsing.

Trade Wars Are Financial Wars in Disguise

Trade policy now directly affects financial stability.

Tariffs, export controls, and industrial subsidies distort capital flows and investment decisions. Companies delay expansion. Investors retreat to safety. Inflation rises as efficiency falls.

The World Trade Organization has repeatedly highlighted that geopolitical trade restrictions undermine global growth and financial predictability

(https://www.wto.org).

Trade wars don’t just raise prices—they destabilize financial expectations.

Debt, Politics, and the Confidence Trap

High public debt is not new. What is new is political unwillingness to manage it responsibly.

When governments use debt for short-term political gain rather than long-term stability, markets eventually react. Confidence erodes faster than balance sheets.

A debt crisis triggered by political paralysis can ignite a Global Financial Shock even in otherwise strong economies.

Currency Power and Political Trust

Currencies are ultimately political instruments backed by institutions, laws, and credibility.

When political instability undermines:

- Central bank independence

- Fiscal discipline

- Rule of law

currency markets respond brutally.

The Bank for International Settlements has emphasized that monetary stability depends as much on governance as on economics

(https://www.bis.org).

Once trust cracks, capital flight accelerates.

Technology, Regulation, and Sudden Disruption

Financial systems increasingly rely on digital infrastructure—payments, clearing, data, and cybersecurity.

Political decisions affecting:

- Data sovereignty

- Technology access

- Digital finance rules

can disrupt markets instantly.

Unlike bank failures, these disruptions don’t build slowly—they happen overnight.

Why Markets Are Vulnerable to Political Shock

Markets can price risk—but they struggle to price uncertainty.

Political decisions are:

- Binary

- Sudden

- Often ideological

This makes them harder to hedge.

A surprise policy announcement can erase trillions in market value before institutions can respond.

That is why the next Global Financial Shock is more likely to feel abrupt and chaotic.

Emerging Markets: The First Casualties

Emerging economies are often the first to feel political financial shocks.

Capital flows reverse quickly. Currencies weaken. Borrowing costs spike. Even countries with strong fundamentals suffer collateral damage.

This contagion effect turns local political events into global crises.

The Psychology of Fear and Herd Behavior

Financial crises are not purely economic—they are psychological.

When political instability signals that rules may change suddenly, fear spreads faster than facts. Investors move together, amplifying volatility.

Once fear dominates, fundamentals matter less.

This is how political risk transforms into a Global Financial Shock.

Can This Be Prevented?

Not entirely—but it can be managed.

Stability depends on:

- Predictable governance

- Transparent policy-making

- Institutional independence

- International cooperation

When politics respects economic limits, markets remain resilient.

When politics ignores them, markets retaliate.

Conclusion: The Crisis Will Be Political Before It Is Financial

The next crisis will not begin with toxic assets or failing banks. It will begin with decisions—made for power, ideology, or short-term gain—that markets cannot absorb smoothly.

The next Global Financial Shock will start in politics, spread through confidence, and end in balance sheets.

Those who understand this shift early will be better prepared than those still watching bank ratios.

What happens if the U.S. Dollar Loses Reserve Currency Status? A step-by-step breakdown of global markets, trade, inflation, geopolitics, and financial power shifts.