Meta Description:

The Trump 10% credit card cap proposal could dramatically change U.S. consumer credit, banking profits, and household debt. Here’s what it means for Americans.

Table of Contents

Introduction: A Proposal That Hit a Financial Nerve

When Donald Trump proposed a nationwide cap on credit card interest rates at 10%, the reaction was immediate and intense. Banks warned of disrupted credit markets, economists debated unintended consequences, and millions of consumers welcomed the idea with cautious optimism.

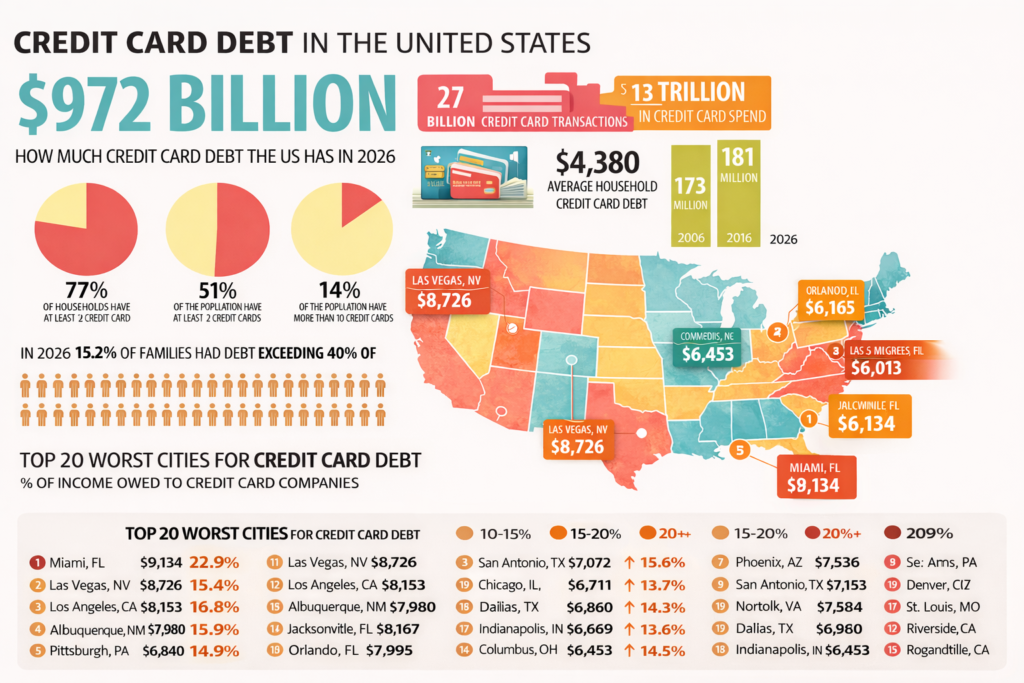

At a time when household debt is rising and interest rates remain elevated, the Trump 10% credit card cap has emerged as one of the most talked-about financial policy ideas in the United States. It touches a deeply personal issue: the cost of borrowing for everyday survival.

This blog explains what the proposal is, why it matters now, and how it could impact consumers, lenders, and the broader U.S. economy.

What Is the Trump 10% Credit Card Cap?

The proposal calls for limiting credit card interest rates to a maximum of 10%, at least temporarily. The goal is to reduce the financial burden on households facing high interest charges that often exceed 20% or even 30%.

Supporters argue that such rates trap consumers in cycles of debt. Critics argue that price controls distort credit markets. Either way, the Trump 10% credit card cap represents a sharp break from decades of hands-off policy toward consumer lending.

For context on current credit card rates:

https://www.federalreserve.gov/releases/g19/current/

Why This Proposal Is Gaining Attention in 2026

Timing matters in policy, and this proposal comes at a sensitive moment.

Key conditions include:

- Record-high revolving credit balances

- Rising delinquency rates

- Slowing consumer spending

- Persistent cost-of-living pressure

As inflation and interest rates strained household budgets, credit cards became a lifeline rather than a convenience. That reality explains why the Trump 10% credit card cap resonates with many voters.

How High Credit Card Rates Affect Consumers

Credit card interest rates are among the most expensive forms of borrowing. Even small balances can balloon over time.

High rates lead to:

- Growing minimum payments

- Slower debt repayment

- Increased defaults

- Financial stress and anxiety

For lower- and middle-income households, this often means paying interest without reducing principal. A cap could offer immediate relief—but it also raises deeper structural questions.

How Banks and Lenders View the Trump 10% Credit Card Cap

From the banking industry’s perspective, credit card lending is risky. Interest rates reflect default risk, operating costs, and regulatory capital requirements.

Banks warn that a strict cap could:

- Reduce credit availability

- Push lenders to tighten approval standards

- Eliminate rewards programs

- Shift costs to annual fees

These concerns fuel opposition to the Trump 10% credit card cap, especially among large financial institutions.

For banking industry analysis:

https://www.reuters.com/markets/us/

Could Consumers Lose Access to Credit?

One of the most debated issues is whether a rate cap would restrict access to credit for higher-risk borrowers.

Historically, interest rate ceilings have sometimes led to:

- Reduced lending to subprime borrowers

- Growth of alternative or informal lending

- Greater reliance on payday-style products

This raises the possibility that while some consumers benefit, others may be excluded from the formal credit system.

A Political and Economic Calculation

The proposal is not just economic—it is political.

Capping rates appeals to:

- Debt-burdened households

- Younger voters

- Lower-income consumers

At the same time, it challenges powerful financial interests. The Trump 10% credit card cap sits at the intersection of populism, consumer protection, and financial regulation.

For historical context on interest rate caps:

https://www.investopedia.com/terms/u/usury.asp

Impact on the Broader U.S. Economy

Consumer spending drives nearly 70% of U.S. GDP. Any policy affecting consumer credit has ripple effects.

Possible macro impacts include:

- Reduced interest income for banks

- Changes in consumer spending patterns

- Shifts in credit risk across the system

- Market volatility in financial stocks

If implemented carefully, a cap could stabilize household finances. If implemented abruptly, it could create short-term disruptions.

Lessons From History and Other Countries

Interest rate caps are not new. The U.S. itself had stricter usury laws in the past, and many countries still enforce lending limits.

Results have been mixed:

- Some caps reduced exploitation

- Others pushed lending underground

- Success depended on enforcement and design

This history suggests the Trump 10% credit card cap would need careful calibration rather than a one-size-fits-all rule.

Why This Debate Reflects a Bigger Problem

The popularity of the proposal highlights a deeper issue: American households are increasingly dependent on debt to maintain living standards.

Stagnant real wages, rising housing costs, and volatile expenses make credit cards a financial bridge. A rate cap treats the symptom—but the underlying causes remain unresolved.

What Happens Next?

At this stage, the proposal is a political signal rather than enacted law. Still, it has already shifted the conversation.

Expect:

- Congressional debate

- Banking sector lobbying

- Market speculation

- Consumer advocacy momentum

Whether or not it becomes policy, the Trump 10% credit card cap has forced a national discussion about fairness, risk, and financial stability.

Final Verdict: Relief or Risk?

There is no simple answer.

For millions of Americans, a cap offers immediate relief from crushing interest costs. For lenders, it raises concerns about risk pricing and credit access. For policymakers, it tests how far intervention should go in consumer finance.

What’s clear is that the proposal reflects real economic stress—and that makes it politically powerful.

Final Thoughts

The Trump 10% credit card cap is more than a headline. It is a reflection of changing attitudes toward debt, fairness, and the role of government in financial markets.

As economic pressure builds, ideas once considered radical are entering the mainstream. Whether this proposal becomes law or not, it signals that consumer credit policy in America may be entering a new era.

👉 When debt becomes a survival tool, financial rules inevitably come under scrutiny.

How Sanctions as an Economic Weapon continue to shape global power, markets, and geopolitics—and why the U.S. still dominates this financial battlefield.