Why oil prices remain critical to the U.S. Economy in 2026. Discover how energy costs influence inflation, jobs, consumer spending, markets, and America’s financial stability.

Table of Contents

Introduction: Oil Never Really Left the Economic Story

Every few years, a familiar argument returns: Does oil still matter? With the rise of renewable energy, electric vehicles, and advanced technology, some believe oil has lost its grip on the American economy.

That assumption is misleading.

In reality, oil prices continue to quietly shape growth, inflation, consumer behavior, and financial markets. In the U.S. Economy in 2026, oil may no longer dominate headlines the way it once did, but its influence remains deeply embedded in everyday economic life.

Why Oil Prices Still Matter More Than We Think

Oil is not just fuel for cars. It is an input for transportation, manufacturing, agriculture, chemicals, logistics, and even consumer goods packaging.

When oil prices move, costs ripple across the economy:

- Transportation becomes more expensive

- Supply chains feel pressure

- Businesses adjust pricing

- Consumers face higher living costs

Even modest changes in oil prices can amplify inflation or slow growth, making energy markets a key variable for the U.S. Economy in 2026.

Oil and Inflation: A Direct and Indirect Relationship

Oil prices have a powerful relationship with inflation.

Direct Impact

Higher oil prices raise gasoline, diesel, and heating costs almost immediately. These increases are highly visible to consumers and influence inflation expectations.

Indirect Impact

Oil affects:

- Food prices (fertilizers, transport)

- Airline tickets

- E-commerce delivery

- Manufacturing inputs

This indirect effect often lasts longer than the initial fuel price spike, keeping inflation sticky even when demand cools.

For inflation dynamics:

https://www.investopedia.com/terms/i/inflation.asp

Consumer Spending and Oil Price Sensitivity

American consumers remain highly sensitive to energy costs. Rising fuel prices reduce discretionary spending, especially for middle- and lower-income households.

In the U.S. Economy in 2026, consumer resilience has already weakened due to high interest rates and lingering inflation. Oil price spikes add another layer of pressure, forcing households to cut back on travel, dining, and non-essential purchases.

This makes oil a silent driver of consumption trends.

The Labor Market and Energy-Linked Jobs

Oil prices influence employment in multiple ways.

Energy Sector Jobs

Higher prices support:

- Drilling and exploration

- Refining

- Energy services

Lower prices often trigger layoffs and investment cuts in oil-producing states.

Broader Labor Impact

Energy costs affect:

- Manufacturing margins

- Logistics employment

- Airline and transport hiring

These effects feed directly into job security across regions, shaping labor conditions in the U.S. Economy in 2026.

Oil Prices and Financial Markets

Energy prices are closely watched by investors because they signal both inflation risk and growth momentum.

- Rising oil prices can hurt stocks by increasing costs

- Falling oil prices may signal weakening demand

- Energy stocks respond sharply to price changes

Bond markets also react, as oil-driven inflation affects interest-rate expectations. This makes oil a key input in financial forecasting and asset pricing.

For energy market fundamentals:

https://www.eia.gov/

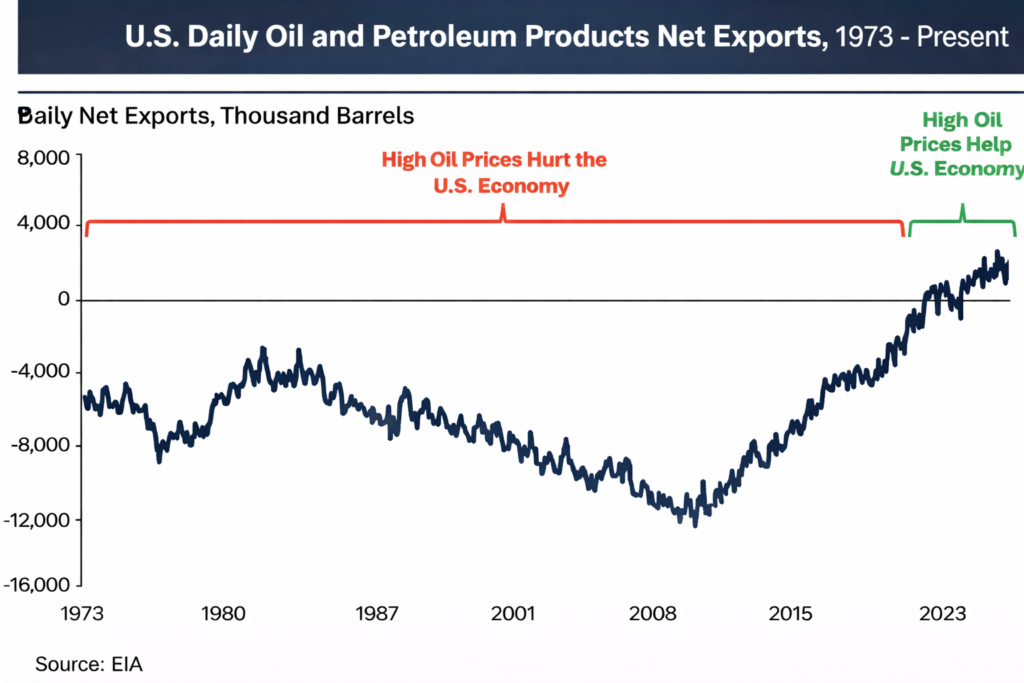

America’s Energy Independence—Myth or Reality?

The U.S. is now one of the world’s largest oil producers, leading many to believe oil prices matter less domestically.

Production strength helps—but it doesn’t fully shield the economy.

Oil is priced globally. Even domestic producers operate within international markets. Disruptions abroad still affect prices at home, meaning global supply shocks remain relevant to the U.S. Economy in 2026.

Geopolitics and Oil Volatility

Oil markets are highly sensitive to geopolitical events:

- Conflicts in energy-producing regions

- Sanctions and trade restrictions

- Shipping route disruptions

These factors can trigger rapid price spikes regardless of domestic conditions. As global tensions remain elevated, oil volatility continues to pose economic risks.

For global energy insights:

https://www.worldbank.org/en/research/commodity-markets

Renewable Energy Hasn’t Replaced Oil—Yet

While renewable energy is growing, oil still dominates:

- Transportation fuel

- Aviation

- Heavy industry

- Petrochemicals

Electric vehicles reduce gasoline demand over time, but infrastructure, cost, and adoption barriers mean oil remains essential in the U.S. Economy in 2026.

The transition is gradual—not abrupt.

Oil Prices and Government Policy Decisions

Energy prices influence policymaking more than many realize.

Rising oil prices can:

- Delay interest-rate cuts

- Increase pressure for subsidies or tax relief

- Shape foreign policy decisions

Governments closely monitor energy markets because public reaction to fuel prices is swift and political consequences can be severe.

Why Oil Still Shapes Economic Confidence

Beyond data, oil prices affect psychology.

High fuel prices:

- Increase financial anxiety

- Reduce consumer confidence

- Trigger pessimism about the economy

Confidence plays a critical role in spending and investment decisions, reinforcing oil’s importance in shaping economic sentiment.

For consumer sentiment data:

https://www.conference-board.org/topics/consumer-confidence

Could Oil Ever Stop Mattering?

For oil to lose relevance entirely, several changes would need to happen at once:

- Massive renewable adoption

- Full electrification of transport

- Stable global energy politics

- Affordable energy storage at scale

While progress continues, these conditions are not yet met. Until then, oil remains a structural force in the U.S. Economy in 2026.

Final Verdict: Oil’s Role Has Changed, Not Disappeared

Oil no longer defines economic success on its own—but it still shapes outcomes.

In 2026, oil prices influence inflation, consumer behavior, jobs, markets, and policy decisions. Ignoring energy markets means missing one of the most powerful undercurrents shaping America’s economic trajectory.

Final Thoughts on U.S. Economy in 2026

The story of oil is no longer about dominance—it’s about dependence.

As the U.S. balances energy transition with economic stability, oil remains a critical variable. Understanding its influence helps explain why prices, confidence, and growth move the way they do.

👉 In a modern economy, oil may be quieter—but it is still powerful.

Discover how wars, geopolitical tensions, and global instability often reinforce the U.S. Financial System, driving capital flows, dollar demand, and market dominance.