Discover how Currency Wars shape everyday life across the world—affecting prices, jobs, savings, travel, and long-term financial security during global economic tensions.

Table of Contents

Introduction: Currency Wars Are Not Just a Government Problem

Most people believe currency movements are something only economists, traders, or governments worry about. Exchange rates feel distant—numbers changing on screens in financial news.

But the reality is far more personal.

Currency Wars directly affect the cost of food you buy, the fuel you use, the job you hold, the interest on your loans, and even the future value of your savings. While governments compete for economic advantage, ordinary people often pay the hidden price.

This blog explains what Currency Wars are, why they happen, and how they quietly influence daily life across the world—from developed economies to emerging markets.

What Are Currency Wars?

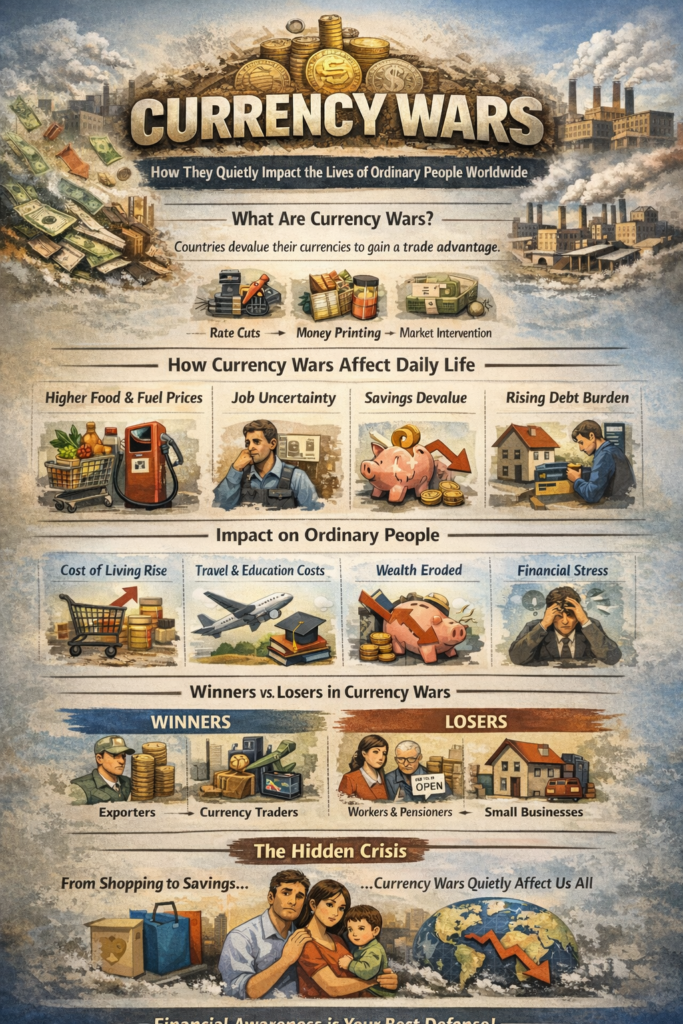

Currency Wars occur when countries deliberately try to weaken their own currency to gain economic advantages, mainly in global trade. A weaker currency makes exports cheaper and imports more expensive.

Governments and central banks may use:

- Interest rate cuts

- Money printing

- Direct currency market intervention

- Capital controls

The goal is competitiveness—but when many countries do this simultaneously, it becomes a global conflict without weapons.

Why Governments Engage in Currency Wars

At first glance, weakening a currency sounds harmful. So why do governments do it?

Key Motivations Behind Currency Wars

- Boost exports and local manufacturing

- Reduce trade deficits

- Manage high debt levels

- Stimulate economic growth during recessions

In theory, these policies support national economies. In practice, Currency Wars often shift pain downward—from institutions to individuals.

How Currency Wars Affect the Cost of Living

The most immediate impact of Currency Wars is inflation.

When a currency weakens:

- Imported goods become expensive

- Fuel and energy prices rise

- Food costs increase

- Electronics, medicines, and raw materials cost more

For ordinary households, this means earning the same income but paying more for essentials.

This effect is especially severe in countries that depend heavily on imports.

Learn more about inflation dynamics:

https://www.investopedia.com/terms/i/inflation.asp

Currency Wars and Your Job Security

Currency Wars influence employment in subtle but powerful ways.

Short-Term Effects

- Export-driven industries may grow

- Manufacturing jobs may temporarily increase

Long-Term Effects

- Rising costs reduce corporate profits

- Companies cut costs and automate

- Wage growth fails to match inflation

In many cases, workers experience job uncertainty combined with declining purchasing power—a dangerous combination.

How Currency Wars Erode Savings and Wealth

For middle-class families, savings are often stored in:

- Bank deposits

- Fixed-income instruments

- Local currency assets

During Currency Wars:

- Currency value declines

- Interest rates may stay low

- Real returns turn negative

This means people save responsibly but still lose wealth over time.

Those without access to global assets are hit the hardest.

Reference on currency devaluation:

https://www.worldbank.org/en/topic/macroeconomics

Currency Wars and Rising Debt Burden

Currency Wars don’t just affect prices—they affect debt too.

How Debt Becomes Heavier

- Foreign-currency loans become more expensive

- Interest rates rise to control inflation

- Household EMIs increase

For individuals with:

- Education loans

- Home loans

- Business credit

Currency instability can quietly push them toward financial stress—even without lifestyle changes.

Impact on Travel, Education, and Migration

Currency Wars influence personal aspirations.

Travel

- Foreign travel becomes costly

- International vacations shrink

- Overseas medical and education costs rise

Education

- Studying abroad becomes unaffordable

- Scholarships lose value due to exchange rate shifts

Migration

- Remittances fluctuate

- Migrant families face income uncertainty

A weakening currency limits global mobility for ordinary people.

Currency Wars in Developing vs Developed Countries

The impact of Currency Wars is not equal.

In Developing Economies

- Higher inflation sensitivity

- Limited social safety nets

- Heavy reliance on imports

In Developed Economies

- Stronger currencies absorb shocks

- Better financial infrastructure

- Higher household resilience

This creates global inequality, where the poorest populations bear the largest burden of currency conflicts.

Who Actually Benefits from Currency Wars?

While most people struggle, some groups benefit.

Winners in Currency Wars

- Exporters

- Multinational corporations

- Currency traders

- Asset holders with global exposure

Losers in Currency Wars

- Salaried workers

- Pensioners

- Small business owners

- Fixed-income households

Currency Wars act as a wealth transfer mechanism, not a wealth creation tool.

Psychological Impact on Ordinary People

Beyond numbers, Currency Wars affect mindset.

People experience:

- Financial anxiety

- Loss of long-term planning confidence

- Reduced trust in institutions

- Fear-driven spending or hoarding

These psychological effects often outlast the economic cycle itself.

Can Individuals Protect Themselves from Currency Wars?

You cannot stop Currency Wars—but you can prepare.

Practical Protection Strategies

- Diversify assets geographically

- Avoid excessive foreign-currency debt

- Build skills that generate global income

- Maintain emergency liquidity

- Stay informed about macro trends

Financial awareness is the strongest defense against currency instability.

Learn about diversification basics:

https://www.investopedia.com/terms/d/diversification.asp

Are Currency Wars Inevitable in the Future?

As long as:

- Countries compete economically

- Debt levels remain high

- Growth remains uneven

Currency Wars are likely to continue.

Digital currencies, geopolitical tensions, and global trade realignments may even intensify these conflicts.

For ordinary people, this means uncertainty will become a permanent feature of financial life.

The Silent Nature of Currency Wars

The most dangerous aspect of Currency Wars is their invisibility.

There are:

- No headlines screaming “currency conflict”

- No sirens or emergencies

- No clear moment of crisis

Yet their effects slowly reshape:

- Household budgets

- Career paths

- Wealth distribution

- Economic opportunity

People don’t notice Currency Wars until their standard of living quietly declines.

Final Verdict: Why Currency Wars Matter to Everyone

Currency Wars are not abstract economic games. They are real-life forces shaping daily survival and long-term security.

They decide:

- How far your salary goes

- Whether savings grow or shrink

- How expensive life becomes over time

Understanding Currency Wars does not make you immune—but it makes you less vulnerable.

Final Thoughts

The global economy may be driven by governments and institutions, but the consequences of Currency Wars land directly on ordinary people.

Those who ignore currency dynamics often feel confused when life becomes expensive without explanation. Those who understand them can adapt, protect themselves, and plan smarter.

The world may continue fighting silent financial battles—but awareness remains your strongest shield.

👉 In a world of Currency Wars, financial literacy is no longer optional—it is survival.

During economic turmoil, which asset truly protects wealth—Gold vs Stocks vs Real Estate? A deep global analysis of performance, risks, and survival strategies in crises.