During economic turmoil, which asset truly protects wealth—Gold vs Stocks vs Real Estate? A deep global analysis of performance, risks, and survival strategies in crises.

Table of Contents

Introduction: Why Global Crises Test Every Asset

Whenever the world faces uncertainty—wars, pandemics, financial crashes, or inflation—one question dominates investor thinking:

Where is my money actually safe?

History shows that global crises do not destroy wealth equally. Instead, they redistribute it. Some assets crash, some stagnate, and some quietly protect purchasing power. The debate of Gold vs Stocks vs Real Estate becomes especially intense during these periods because each asset behaves very differently under stress.

This article takes a global, practical, and human-centered view to answer a difficult question:

Which asset truly wins during global crises—and why?

Understanding Global Crises and Asset Behavior

Global crises usually share common features:

- Fear-driven decision-making

- Liquidity shortages

- Market volatility

- Government intervention

- Currency instability

In such conditions, traditional return expectations fail. The real winners are not always the highest-return assets—but the most resilient ones.

To understand Gold vs Stocks vs Real Estate, we must analyze them not in normal times, but in abnormal global conditions.

Gold in Global Crises: The Psychological Safe Haven

Gold has been trusted for thousands of years—not because it generates income, but because it preserves value when trust collapses.

Why Gold Performs Well in Crises

- No counterparty risk

- Limited supply

- Global acceptance

- Hedge against inflation and currency devaluation

During wars, hyperinflation, and systemic collapses, gold often rises while other assets fall.

Where Gold Struggles

- No cash flow

- Long periods of stagnation

- Underperformance during strong economic growth

In the Gold vs Stocks vs Real Estate debate, gold is not about growth—it is about survival.

Historical reference:

https://www.investopedia.com/articles/investing/071114/why-gold-safe-haven.asp

Stocks in Global Crises: Pain First, Reward Later

Stocks represent ownership in businesses, which makes them highly sensitive to economic slowdowns.

What Happens to Stocks During Crises

- Sharp declines (30–60% is common)

- Panic selling

- Corporate earnings collapse

- Liquidity-driven crashes

In the short term, stocks often perform the worst during global crises.

Why Stocks Still Matter

- Businesses adapt and recover

- Governments support markets

- Long-term growth resumes

Historically, stock markets have recovered from every global crisis, often reaching new highs.

In Gold vs Stocks vs Real Estate, stocks lose first—but often win in the long run.

Market history reference:

https://www.worldbank.org/en/research/brief/stock-markets-and-economic-crises

Real Estate in Global Crises: Stability with Hidden Risks

Real Estate sits between gold and stocks—less volatile, but less liquid.

Strengths of Real Estate in Crises

- Physical asset

- Rental income potential

- Inflation hedge (in some regions)

- Emotional security for owners

During moderate crises, real estate prices often fall slower than stocks.

Weaknesses Exposed in Crises

- Illiquidity

- High debt risk

- Maintenance and tax costs

- Location-dependent performance

In severe global crises, over-leveraged real estate investors suffer heavily.

Within Gold vs Stocks vs Real Estate, property rewards patience—but punishes excessive borrowing.

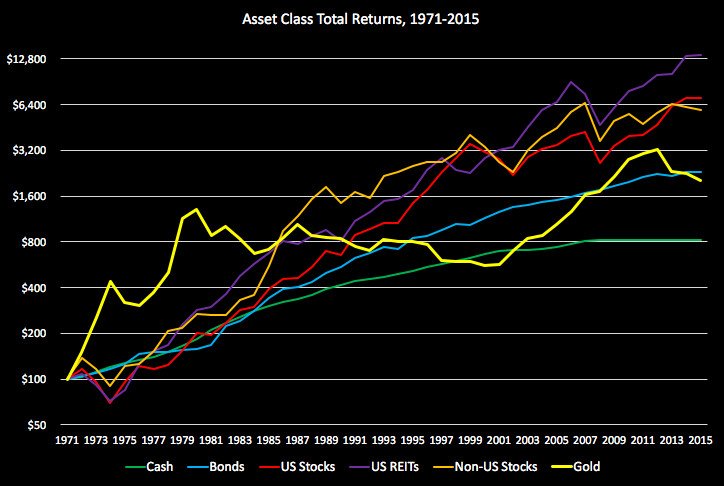

Performance Comparison During Major Global Crises

1. Great Depression (1930s)

- Gold: Preserved value

- Stocks: Collapsed

- Real Estate: Illiquid, slow recovery

2. 2008 Financial Crisis

- Gold: Strong rise

- Stocks: Massive crash, later recovery

- Real Estate: Severe damage in leveraged markets

3. COVID-19 Crisis

- Gold: Short-term surge

- Stocks: Fast crash, fastest recovery

- Real Estate: Mixed performance globally

Each crisis tells the same story: no single asset wins every time.

Liquidity vs Safety: The Core Trade-Off

A key factor in Gold vs Stocks vs Real Estate is liquidity.

| Asset | Liquidity | Safety | Growth |

|---|---|---|---|

| Gold | High | High | Low |

| Stocks | Very High | Medium | High |

| Real Estate | Low | Medium | Medium |

During crises, liquidity itself becomes a form of power.

Inflation, Currency Risk, and Global Perspective

Global crises often trigger:

- Money printing

- Currency devaluation

- Rising living costs

Asset Response to Inflation

- Gold: Strong hedge

- Stocks: Partial hedge (via pricing power)

- Real Estate: Location-dependent hedge

In emerging economies, currency risk makes gold and real assets more attractive than financial assets alone.

This global reality shifts the balance in Gold vs Stocks vs Real Estate depending on geography.

Emotional vs Rational Investing in Crises

Crises expose investor psychology.

People:

- Sell stocks at the bottom

- Buy gold at the top

- Hold real estate emotionally

The biggest losses in Gold vs Stocks vs Real Estate debates often come from bad timing, not bad assets.

Human behavior—not asset quality—decides outcomes.

Which Asset Actually Wins in Global Crises?

The honest answer: None wins alone.

Gold Wins When:

- Trust collapses

- Inflation spikes

- Currencies weaken

Stocks Win When:

- Recovery begins

- Innovation accelerates

- Long-term growth resumes

Real Estate Wins When:

- Inflation persists

- Population demand stays strong

- Debt levels are manageable

The real winner in Gold vs Stocks vs Real Estate is diversification.

Smart Global Crisis Strategy (Balanced Approach)

Instead of choosing one side, smart investors combine assets:

- Gold for stability

- Stocks for growth

- Real Estate for income and inflation hedge

This approach reduces emotional stress and improves long-term outcomes.

Learn more about diversified investing:

https://www.investopedia.com/terms/d/diversification.asp

Common Mistakes People Make During Crises

- Going all-in on one asset

- Over-leveraging real estate

- Panic selling stocks

- Treating gold as a growth asset

Crises reward discipline—not predictions.

The Future of Gold, Stocks, and Real Estate in Global Crises

Future crises may look different, but human behavior will not change.

Trends shaping the future:

- Digital gold (ETFs)

- Global stock access

- Fractional real estate ownership

- Faster market reactions

The Gold vs Stocks vs Real Estate debate will continue—but the smartest investors will stop choosing sides and start building systems.

Final Verdict: What Should You Do?

Instead of asking which asset wins, ask:

- What protects my purchasing power?

- What grows over decades?

- What lets me sleep during uncertainty?

Global crises do not destroy prepared investors—they create them.

Final Thoughts

Every crisis teaches the same lesson in a new way.

Gold protects fear.

Stocks reward patience.

Real Estate rewards discipline.

The true winner in Gold vs Stocks vs Real Estate is not an asset—it’s the investor who understands when and why each one matters.

The next global crisis is not a question of if, but when.

The real question is:

👉 Will your assets fight each other—or work together?

Global Recession Cycles: How Every Generation Loses—and Wins—Money